| NSPM in English | |||

Huge National Debts Could Push Euro Zone into Bankruptcy |

|

|

|

| четвртак, 06. мај 2010. | |

|

(Der Spiegel, May 3, 2010)

The Mother of All Bubbles Savvas Robolis is one of Greece's most distinguished economics professors. He advises cabinet ministers and union bosses. He is also a successful author and a frequent guest on the country's highest-rated talk shows. But for several days now, it has been clear to Robolis, 64, the elder statesman of Greece's left-wing academia, that he no longer has any influence. His opposite number, Poul Thomsen, the Danish chief negotiator for the International Monetary Fund (IMF), is currently something of a chief debt inspector in the virtually bankrupt Mediterranean country. He recently took three-quarters of an hour to meet with Robolis and Giannis Panagopoulos, the president of the powerful trade union confederation GSEE. At 9 a.m. on Tuesday of last week, the men met behind closed doors in a conference room in the basement of the Grande Bretagne, a luxury hotel in Athens. The mood, says Robolis, was "icy." Robolis told the IMF negotiator that radical wage cuts would be toxic for Greece's already comatose economy. He said that the Greeks, given their weak competitive position, primarily needed innovation and investment, and that a one-sided fixation on cleaning up the national budget would destroy the last vestiges of economic strength in Greece. The IMF, according to Robolis, could not make the same mistake as it did in Argentina in the early 1990s. "Don't put Greece on ice!" the professor warned. But the tall Dane was not very impressed. He has negotiated aid packages with Iceland, Ukraine and Romania in the past, and when he and his 20-member delegation landed in Athens on April 18, they had come to impose a rigorous austerity program on the Greeks, not to devise long-term growth programs. Thomsen's mandate is to save the euro zone. And any Greek resistance is futile.

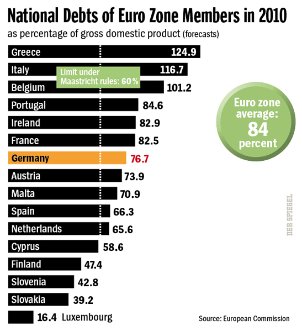

Robolis versus Thomsen. For the moment, this is the last skirmish between the old ideas and ideals of prosperity paid for on credit and a generous state, against the new realization that the time has come to foot the bill. The only question is: Who's paying? The euro zone is pinning its hopes on Thomsen and his team. His goal is to achieve what Europe's politicians are not confident they can do on their own, namely to bring discipline to a country that, through manipulation and financial inefficiency, has plunged the European single currency into its worst-ever crisis. If the emergency surgery isn't successful, there will be much more at stake than the fate of the euro. Indeed, Europe could begin to erode politically as a result. The historic project of a united continent, promoted by an entire generation of politicians, could suffer irreparable damage, and European integration would suffer a serious setback -- perhaps even permanently. And the global financial world would be faced with a new Lehman Brothers, the American investment bank that collapsed in September 2008, taking the global economy to the brink of the abyss. It was only through massive government bailout packages that a collapse of the entire financial system was averted at the time. A similar scenario could unfold once again, except that this time it would be happening at a higher level, on the meta-level of exorbitant government debt. This fear has had Europe's politicians worried for weeks, but their crisis management efforts have failed. For months, they have been unable to contain the Greek crisis. Attacked by Speculators European governments agree that saving Greece is imperative. They are worried about the euro, and the Germans are concerned about their banks, which, lured by the prospect of high returns, have become saturated with government bonds from Greece and other southern European countries. They are also terrified that after a Greek bankruptcy, other weak euro countries could be attacked by speculators and forced to their knees. There are, in fact, striking similarities to the Lehman bankruptcy. This isn't exactly surprising. The financial crisis isn't over by a long shot, but has only entered a new phase. Today, the world is no longer threatened by the debts of banks but by the debts of governments, including debts which were run up rescuing banks just a year ago. The banking crisis has turned into a crisis of entire nations, and the subprime mortgage bubble into a government debt bubble. This is why precisely the same questions are being asked today, now that entire countries are at risk of collapse, as were being asked in the fall of 2008 when the banks were on the brink: How can the calamity be prevented without laying the ground for an even bigger disaster? Can a crisis based on debt be solved with even more debt? And who will actually rescue the rescuers in the end, the ones who overreached? 'Great Sacrifices' Take, for example, the countries that will pay for the Greek bailout. The country could need as much as €120 billion or €130 billion -- or even more -- over the next three years. At the weekend, euro-zone members and the IMF agreed on a €110 billion bailout package over three years. The EU will provide €80 billion in loans, with Germany's share over three years amounting to €22 billion, including €8.4 billion in the first year alone. Greece will have to impose further austerity measures in return. Greek Prime Minister George Papandreou said they would involve "great sacrifices," saying: "It is an unprecedented support package for an unprecedented effort by the Greek people." Euro-zone leaders will formally launch the package, which still needs to be approved by the German Bundestag and a number of other euro-zone parliaments, at a summit on Friday. The aid will be released ahead of May 19, when Greece next needs to make debt repayments. Caught in the Maelstrom The money would be well invested if Athens succeeds in getting its state finances under control within the three-year time period, through rigid austerity measures and successful economic management. But if it doesn't? Then the money, or at least some of it, will be gone. Then all the things that the rescue measures were intended to prevent could in fact transpire: Lenders would have to write off their claims, banks would have to be rescued once again, speculators would force the rest of the weak PIIGS nations (Portugal, Ireland, Italy, Greece and Spain) to their knees -- and the euro would fall apart. If that happened, the rescuers themselves would be at risk. Even Germany, in international terms a country with relatively sound finances, has amassed enormous debts. If it became caught up in the maelstrom of a euro crisis, the consequences would be unforeseeable. The credit rating of Europe's strongest economy would be downgraded and Germany would have to pay higher and higher interest rates for more and more loans. Future generations would shoulder an even greater burden as a result. But what is the alternative? Should Europe simply allow Greece to go bankrupt instead? In that case, the possible future scenario would happen right away instead. One might argue that it is better to get things over quickly, even if that is painful, rather than prolonging the agony. But one can also hope that everything will turn out for the best in the end. The euro-zone countries prefer to hope, which is why they have agree to a rescue program that will provide Greece with the funds it can no longer borrow on the open market, now that it is being forced to pay such high interest rates. Part 2: Living Beyond Their Means The whole world lives on the principle of hope: hope that it will be possible to repay the debt that has accumulated in past years, that governments will manage to clean up their ailing budgets, thereby averting the worst, and that life will go on, just as life has always gone on, somehow, after earlier crises. All of the major industrialized countries have lived beyond their means for decades. Even in good times, government budget deficits continued to expand. The United States, in particular, paid for its prosperity on credit. The poor example set by the state was contagious -- US citizens began buying cars and houses they couldn't really afford, and banks speculated with borrowed money. Things couldn't possibly go well forever and, indeed, the financial crisis put an end to the days of unfettered spending. To avert a collapse, governments came to the rescue with vast sums of money, guaranteed their citizens' savings and jump-started the economy with massive stimulus programs -- all with borrowed money, of course. A Huge Bubble The world was saved, temporarily at least, but since then it has accumulated more debt than ever before in peacetime. The national deficits of the 30 members of the Organization for Economic Cooperation and Development (OECD) have grown almost sevenfold since 2007, to about $3.4 trillion today. Their total debt burden has also grown dramatically, to a record-setting $43 trillion. In the euro zone, national deficits have even grown 12-fold in the same time period, with the euro-zone countries accumulating $7.7 trillion in debt. The current government debt bubble is the last of all possible bubbles. Either governments manage to slowly let out the air, or the bubble will burst. If that happens, the world will truly be on the brink of disaster. When Greece faces a possible bankruptcy, the euro-zone countries and the IMF come to its aid. But what happens if the entire euro group bites off more than it can chew? What if the United States can no longer service its debt because, say, China is no longer willing to buy American treasury bonds? And what if Japan, which is running into more and more problems, falters in its attempts to pay for its now-chronic deficits? The conditions that prevail in Greece exist in many countries, which is why governments around the world are paying such close attention to how -- and if -- the Europeans gain control over the crisis. Warning Shot to the Markets Athens' empty coffers were already of concern to the financial markets early last year. At the end of January 2009, yields on Greek government bonds had jumped to almost 7 percent, the highest level since Greece joined the euro zone. At the time, there was already speculation over possible bankruptcies in Europe and a breakup of the euro zone. What at the time looked like scaremongering has now become bitter reality -- because politicians didn't take the warning signs seriously. At an event organized by Germany's center-left Social Democratic Party bearing the hopeful title "The New Decade," then-German Finance Minister Peer Steinbrück uttered a sentence that, for many, shook the euro to its very foundations. If one of the euro countries ran into difficulties, he said, "all of the euro-zone members would have to help." The sentence was a warning shot to the market, and the markets paid attention. The risk premiums on Greek bonds declined continuously. In early October, the country was still able to borrow money at about 4 percent, a rate only slightly higher than what Germany was paying. This period was probably the EU's last opportunity to force the Greeks to introduce truly effective austerity measures. But the window was left unexploited. New Era On Oct. 20, a new era began for the Greeks. On that day, the newly appointed finance minister, George Papaconstantinou, announced a "correction" of the country's deficit figures. According to Papaconstantinou, the national deficit would not amount to 5 percent of gross domestic product, as the government in Athens had reported to Brussels, but 12.5 percent. Things happened very quickly after that. Greek government bonds have been continuously downgraded since then, most recently to junk status, and European governments have been negotiating the conditions under which they are willing to bail out the country. Finally, on Friday, April 23, Prime Minister George Papandreou officially asked the IMF and the euro zone countries for help. The German government is partly to blame for allowing things to reach this point. The coalition government in Berlin, which brings together the center-right Christian Democrats (CDU/CSU) and the business-friendly Free Democratic Party (FDP), which got off to a haphazard start, has also acted unprofessionally in what has been its most difficult test to date. While the Greek debt problem was expanding into a risk to the global financial system, the coalition remained stubbornly focused on another problem: state elections in North Rhine-Westphalia on May 9. The vote is crucial to German Chancellor Angela Merkel because it will determine whether the Christian Democrats and the FDP are able to maintain their majority in the Bundesrat, Germany's upper legislative chamber which represents the interests of the states. 'Iron Chancellor' Image To ensure that the citizens of Germany's most populous state would be favorably disposed toward her party, Merkel, to the applause of the powerful tabloid newspaper Bild, sought to portray herself as the "iron chancellor." She subtly stirred up resentment against the Greeks, staunchly resisted approving an early financial bailout for Athens and sent completely different signals than the most important member of her cabinet, Finance Minister Wolfgang Schäuble. While the chancellor argued for IMF intervention, Schäuble proposed a purely European rescue package. And when Schäuble suggested a new type of bankruptcy proceeding for euro-zone countries, Merkel publicly questioned its feasibility. It was clear to the finance minister that Germany would ultimately be unable to refuse to take part in an international rescue plan. The chancellor, on the other hand, sought to portray herself as a tough opponent of German help for Greece, at least until the critical state election on May 9. The phrase "no money for Athens" was more than just the rallying cry with which the tabloids inflamed public opinion. It was also a recurring refrain within the coalition parties. Under these circumstances, it was no surprise that the CDU and the FDP took the same stance when the struggling government in Athens finally requested financial assistance from Brussels much earlier than planned. "The loans coming from Germany can only be approved if the holders of Greek securities share in the risk," said Leo Dautzenberg, finance spokesman for the Christian Democrats' parliamentary group. Part 3: Calls to Eject Greece from the Euro Zone The Christian Social Union (CSU), the CDU's Bavarian sister party, even went a step further. Hans Michelbach, one of the party's financial experts, proposed an international creditors' conference to discuss the debt restructuring. The mood was no different among the liberals. At the FDP party convention in Cologne on the weekend before last, Chairman Guido Westerwelle barely succeeded in rebuffing a petition to eject Greece and other countries with high deficits from the euro zone. After all, what would be the implications of such a step? It would trigger a panic in other shaky euro-zone countries, investors would pull out their money and it could lead to more bankruptcies. FDP finance expert Frank Schäffler proposed early on that Greece ought to sell its islands to pay off its debt. And veteran FDP politician Burkhard Hirsch said that he wanted to return to Greece "the option to devalue its own currency." German Economics Minister Rainer Brüderle, while on an official trip to Brazil last week, only added to the confusion. Speaking from Sao Paulo, 10,000 kilometers (6,250 miles) from Germany, the FDP politician mentioned figures relating to the scope of the planned bailout package. The only problem was that the figures hadn't been coordinated with other members of the government. He also announced that he planned to make a stopover in Portugal on his way home, so as to gain a "direct impression" of the crisis on the ground. Brüderle was apparently doing his best to fuel the growing panic in the financial markets, said horrified members of his party in Berlin. Consternation in the US The Germans' misguided crisis management was met with consternation worldwide, among European partner countries and in the United States. At a recent meeting of G-7 finance ministers in Washington, US Treasury Secretary Timothy Geithner told Jörg Asmussen, a senior official in the German Finance Ministry who was representing a hospitalized Schäuble, that it was time for the Germans to shed their reluctance. The Greek problem needed to be resolved quickly, Geithner demanded, adding that it was Europe's job to fix the problem and that Germany, as the euro zone's largest economy, was particularly responsible. If the Germans wasted any more time instead of coming up with a quick solution, he said, other countries would run the risk of catching the Greek virus. The US government wasn't just motivated by compassion for the Greeks. In fact, Washington is worried about being drawn into the vortex of national bankruptcies itself. The national debt has exploded in the United States in the last two years, more than in almost any other country, because the government has had to spend hundreds of billions of dollars to support the economy and banks. Geithner fears that investors could also at some point lose confidence in the soundness of American government finances. According to a strictly confidential IMF document, referred to internally as an early warning exercise, the US's finances are still considered sound -- with, however, some qualifications. Growing National Debt The United States is still capable of fulfilling all of its obligations, the document states, but it also points out the worrisome rate at which the national debt is growing. Germany is given high marks, and without qualification. According to the IMF report, Germany has come through the crisis relatively well, and its debt has not grown by nearly as much in other developed countries. In the case of Greece, however, the IMF sees a bright red warning light, and its conclusions for Portugal and Spain are also alarming. In both countries, state finances have deteriorated ominously recently, the IMF experts conclude. For these reasons, an international rescue effort was unavoidable, leading IMF Managing Director Dominique Strauss-Kahn and European Central Bank President Jean-Claude Trichet to launch an unprecedented public relations campaign. Appearing in Berlin last Wednesday, the two top representatives of global finance told the reluctant members of Germany's parliament, the Bundestag, how serious the situation is. Strauss-Kahn's Washington experts estimate the Greeks' financial requirement at €50 billion a year, in a worst-case scenario. That scenario will occur when private lenders refuse to lend the Greeks any more money. The IMF bailout program would total €150 billion over a three-year period. During this time, the IMF would contribute €27 billion, including €15 billion in the first year alone. The IMF is bracing itself to remain in the country for 10 years, until the economic reforms are complete and have come to fruition. For the Greek government, the IMF's presence in Athens will deprive it of a significant amount of its power. Expensive Hesitation After having briefed the financial experts at the Bundestag, Strauss-Kahn met directly with the chancellor. The Germans' hesitation had already made the Greek bailout significantly more expensive, the IMF director complained. The Frenchman wasn't impressed by Merkel's argument that she has to make allowances for the Federal Constitutional Court's skeptical stance toward euro zone bailouts (a number of legal experts have already threatened to file a constitutional complaint with the court if the Bundestag approves a law enabling state aid to Greece). "I don't buy that," Strauss-Kahn said privately after the meeting. The international financial experts' efforts had their intended effect. The politicians in Berlin came around, and now everything is expected to move very quickly. In a special meeting on Monday, the cabinet approved the German portion of the Greek bailout program. Now the package will be pushed through the two houses of parliament, the Bundestag and the Bundesrat, in expedited proceedings, with the first reading of the bill in the Bundestag expected on Wednesday. The two houses could vote on the bill as early as Friday, and German President Horst Köhler could sign it into law the same day. At the same time, the government in Berlin is looking for people to blame for the poor management of the crisis, and some are beginning to point fingers at Finance Minister Schäuble. Merkel's most important cabinet member was barely present in Berlin in recent weeks. A paraplegic, he underwent routine surgery at the beginning of the year, but his wound was slow to heal. Exhausted and Ill-Humored He conducted his official duties from his hospital bed for almost two months. Schäuble was usually represented by Jörg Asmussen, a senior official in the Finance Ministry. Members of the current coalition government are suspicious of Asmussen simply because, as a member of the SPD, he served in the same position under Schäuble's predecessor, Peer Steinbrück. But whenever Schäuble did become directly involved in events in Berlin recently, he came across, according to his fellow party members, as an exhausted and ill-humored veteran politician incapable of drumming up any enthusiasm anymore. On the contrary, CDU and CSU members of the Bundestag resent him for having left them in the dark about the true extent of the Greek crisis for weeks, for repeatedly behaving like someone who was at the mercy of the financial markets and for failing to devise a common approach with the chancellor. Even during the previous grand coalition government, the relationship between the Chancellery and the Finance Ministry was better than it is now, despite the fact that the Christian Democrats control both institutions today. There is already speculation on the back benches of parliament over how much longer Schäuble will remain in office. It is also noticeable that a potential successor appears to be jockeying into position. Roland Koch, the CDU governor of the western state of Hesse, who would have liked to be named finance minister after last September's parliamentary election, pithily summed up the widespread discontent with Berlin's crisis management in an interview with the Berliner Zeitung newspaper last week. "The Christian Democrats and the federal government would be well advised to speak with one voice," he said. Part 4: 'Panic Is Slowly Taking Hold' The rescue package is now a done deal, and the Greeks have a clearer idea of what is in store for them. A European nation has hardly ever been expected to make comparable sacrifices in peacetime. In return for the bailout deal announced Sunday, the Greek government will implement further cost-cutting measures, including drastic reductions in salaries and pensions, further tax hikes and a stricter austerity program for all of the country's public budgets. It won't be long before new unrest and protests erupt among the Greeks, with their penchant for strikes. Metalworkers and candidates for civil service positions took to the streets of Athens last week, and there were further protests over the weekend. "Panic is slowly taking hold in the minds of people," says economics professor Savvas Robolis. Because the Greeks, despite the massive capital injections from Brussels and Washington, face an extremely uncertain future and the country can expect to see "explosive unemployment," Robolis isn't certain that social protests will remain peaceful in the future. If not, speculators will quickly pounce on the euro again. They have made enormous profits in recent weeks and months, after betting on Greece's growing difficulties and a constantly weakening euro. Now they are just waiting for the next opportunity. Reasons to Be Grateful to Hedge Funds But Scottish hedge fund manager Hugh Hendry, 41, doesn't feel guilty. The Germans should be grateful to him, says Hendry, who launched the Eclectica hedge fund in 2005 and now manages $450 million in assets. "Politicians like to gloss over economic reality, but we confront them with the facts," says Hendry. According to Hendry, the Greeks lived beyond their means for years, and now they are no longer competitive. He insists that recognizing this early on was beneficial, because without the warning signals from the financial markets, the Greeks would simply have continued muddling along. Using his computer, Hendry projects the interest-rate curve for two-year Greek government bonds onto a large screen on the wall of his office in London's trendy Notting Hill neighborhood. He is excited by the clarity of the trend, which clearly points upward. "The causes of a crisis are usually of a fundamental nature, but hedge fund speculation can lead to excessive prices," says Bernd Berg, who wrote a doctoral thesis about the influence of hedge funds on financial crises like the one in Asia in 1997-98. In that crisis, hedge funds had been betting against the Thai baht for months, until they finally reached their goal. The currency's peg to the dollar was eliminated and it quickly lost value, triggering a major shock in the region. 'Germany Can't Save Everyone' The financial markets have taken note of the probable bailout of Greece by European politicians. "Countries like Ireland and Portugal have very similar problems," says David Owen, chief analyst with the US investment bank Jefferies International. "Germany can't save everyone." Hedge fund managers are betting that the turbulence in the euro zone will continue to increase. Initial attacks on Portugal and Spain -- and probably Ireland too, before too long -- show how the situation could develop. In Portugal, anger against speculators is also uniting politicians from all parties. They cannot understand why the country's debt rating was downgraded last week. The economic situation in Portugal, says António de Sousa, the president of the banking association, didn't just suddenly change on Tuesday. The fact that the rating agencies have downgraded several euro-zone members precisely now, in this precarious situation, has reignited the debate over the quality -- and neutrality -- of the companies. Their negative assessments are aggravating the crisis, which in turn will lead to further downgrades. Stagnating Economy In fact, the Portuguese economy has been stagnating for the last 10 years. It grew substantially before that, after the country had joined the EU. In the years since the introduction of the euro, the Portuguese have gotten used to low interest rates and have "lived completely beyond their means," as President Aníbal Cavaco Silva, an economics professor himself who was also prime minister during the boom years, warned last year. "We spend 10 percent of GDP more than we take in, year after year," says Portuguese economist António Perez Metelo. Private households owe more than 100 percent of their annual income. Because the Portuguese save so little, banks are forced to borrow money abroad. Each of the 10.6 million Portuguese citizens owes foreign banks an average of €18,300 and paid €590 in interest in 2009. This situation cannot continue -- not in Greece, not in Portugal and not in most other countries. But the euro zone isn't the only place with a debt problem. The US budget deficit has now reached $1.6 trillion, or 10 percent of GDP. The national debt is now over $12 trillion and is forecast to expand to more than $20 trillion by the end of the decade. At that point, Americans will be paying $900 billion a year in interest alone. Paying with New Debt Today, only four areas consume almost all government revenues: defense, social programs, health care and interest on debt. Americans must pay for everything else with new debt. Fred Bergsten, director of the Peterson Institute, one of the leading economic think tanks in the United States, warns: "If we don't correct the situation in the next five years, our worldwide position will be in jeopardy." The disastrous financial situation is in large part due, not to the economic stimulus packages and programs to fight the global economic crisis, but to behavior during the years under former President George W. Bush. At the time, Americans became accustomed to consuming far more than they produced. They consume inexpensive goods from Southeast Asia, and the Chinese and the Japanese are only too willing to accept US Treasury bonds in return. In other words, Asia is giving the United States an almost unlimited credit line. This is the only reason the Americans were able to keep interest rates low for so many years -- the cost of borrowing was being kept artificially low. Many people believed that they could afford to buy real estate. And in the belief that the value of their houses was constantly increasing, Americans consumed even more and got into more and more debt. This illusionary system fell apart when the real estate markets collapsed. But current President Barack Obama has also contributed substantially to the biggest American budget deficit since World War II. His healthcare reforms alone will cost the government about $900 billion in the coming years. And the military presence in Iraq and Afghanistan will swallow up $160 billion in the coming budget year. Part 5: How Empires Fall In March, the rating agencies Standard & Poor's and Moody's warned that even the US's perfect triple-A rating could be jeopardized if the country's financial situation didn't change drastically soon. The third main rating agency, Fitch, had already issued a warning in January. So far, none of the three agencies has announced an actual downgrade of the country's credit rating. Economists suspect, however, that the fear of the incalculable consequences for the economy might have prevented them from doing so. At any rate, experts like Harvard economic historian Niall Ferguson warn that confidence in the United States could be lost at some point, and that this could come as a complete surprise, with a single piece of bad news serving as a spark and potentially triggering a global conflagration. The "alarm bells should be ringing loudly" in the United States, says Ferguson. He points out that historically, large empires like the Roman Empire and the Chinese Ming dynasty also fell into decline because they had overextended themselves economically. Warnings like this help explain why US Secretary of State Hillary Clinton defines the crisis as one of historic dimensions. She has argued that the deficit and debt should be viewed "as a matter of national security, not only as a matter of economics." Safe Haven Surprisingly enough, the dollar has managed to make its way through all the turbulence seemingly unscathed. On Wall Street, US securities, particularly American treasury bonds, are still considered a safe haven for investors' money. By studying financial crises over the centuries, US economists Kenneth Rogoff and Carmen Reinhart have calculated an average value at which the debt burden starts to become critical for a country: 90 percent of GDP. Above that level, economies achieve only half as much growth as those that are not as heavily indebted. This key indicator is currently at about 84 percent in the United States, but in two years the Americans are expected to surpass the 100-percent mark. In other words, time is of the essence. Unless the United States takes drastic steps immediately, the public debt will amount to more than 300 percent of GDP by 2050, according to calculations by the Center on Budget and Policy Priorities, the leading fiscal policy think tank in Washington. The prospects are not one iota better on the other side of the world in Japan. Its economy is even more indebted, with the debt burden amounting to almost twice the country's annual economic output. However, hardly any of Japan's creditors are abroad. Instead, most are government institutions and Japanese citizens, so that at least their fate lies in their own hands. Increasing Burdens Nevertheless, the Japanese debt crisis will likely be just as difficult to resolve. Some 22 percent of all Japanese are older than 65 today, and in two decades, when a large percentage of baby boomers will have entered retirement, that number is expected to climb to 30 percent. The burdens that will be imposed on pension funds and the healthcare system by an aging society will cause debt service to continue to rise dramatically in the future, particularly in Japan, but also in several European countries. In Britain, new borrowing has already reached Greek dimensions. The national debt has grown by more than half in only two years, and this year, the budget deficit is expected to make up close to 13 percent of GDP. Rescuing institutions like the Royal Bank of Scotland has come with a price. According to recent figures, the government has already spent about 200 billion pounds (€230 billion, $306 billion) to support the financial industry. And now the country will go to the polls on Thursday. There are many indications that the result will be a hung parliament, so that the new government will lack the strength to make unpopular decisions. "Many industrialized countries face enormous fiscal policy challenges to rectify their escalating government debt," a current study by Deutsche Bank Research concludes. Relatively Unscathed So far, Germany has come through the crisis relatively unscathed, compared with other Western industrialized nations. While Britain and the United States are showing deficits of more than 10 percent of annual economic output for 2009 and 2010, Germany's budget deficit only totaled 3.2 percent in 2009, which is only slightly higher than the euro zone's 3-percent ceiling. This year, the deficit is likely to climb to about 5.5 percent. Unlike most other countries, Germany entered the deepest recession of the postwar era with a balanced budget. As a result, the federal government had to take on less new debt to support the economy and banks during the crisis, as well as to fund the higher costs of rising unemployment. But the absolute figures of German indebtedness reveal the true scope of the challenge. State institutions have borrowed some €1.7 trillion, with more than half of the total attributable to the federal government, which exceeded the €1 trillion threshold last year. The country's states owe a total of €526 billion and municipalities are €112 billion in debt. To date, there has been no question on the financial markets that Germany's federal government, as well as its state and local governments, will live up their obligations. Germany, with a triple-A rating, is considered a borrower with a credit risk of almost zero. German government bonds set the benchmark in Europe. As a result, all three levels of government can borrow money at relatively favorable rates. Part 6: A Tough Course of Cold Turkey But these rates are not always justified. Many local governments are highly indebted. For example, Kiel, the capital of the northern state of Schleswig-Holstein, has liabilities of about €900 million. "My city is just as unable to repay this debt by itself as Greece," admits Kiel Mayor Torsten Albig, a member of the SPD who was also the German Finance Ministry's spokesman until last year. Albig says that he can only borrow new money under preferential terms because Kiel is backed by Germany's good reputation, and because the city does most of its borrowing from the local savings bank and the state-owned bank. "I certainly wouldn't be getting such attractive interest rates from a foreign bank," says Albig. If his city were treated the way Greece is being treated, the consequences would be catastrophic. Instead of €24 million in debt service, the city treasury would be required to pay five times as much. Public swimming pools would have to be closed, and the city wouldn't even have enough money to pay for kindergartens and schools. "This isn't a likely scenario," says Albig, "but it is possible." Three Possible Scenarios So what's next? The world's economies, who were addicted to constant new injections of debt, can expect a tough course of cold turkey. And if they don't undergo the treatment, they will face what amounts to a lingering illness, and some could even collapse. There are three conceivable scenarios, distinguishable mainly by who will ultimately bear the greatest burden: taxpayers, savers or creditors. In the first strategy, the national economies embark on a strict course of austerity measures. To do so, they will have to demand higher taxes from citizens. Or they could limit government spending, which is the approach Ireland, for example, has taken. The government there has cut pay for civil servants by 7.5 percent on average, and recipients of social welfare have also seen their benefits reduced. ECB President Jean-Claude Trichet praises the efforts in Dublin as exemplary. Throughout history, governments have often faced massive pressure to consolidate. It was the approach the United States took after World War II to eliminate its debt. But after years of deprivation, the Americans also had a lot of catching up to do, which translated into strong economic growth. Uncomfortable Adjustments Later on, European countries were repeatedly forced to balance their budgets. To do so, southern countries like Italy and Portugal generally increased their revenues, while northern nations like Denmark and Sweden preferred to reduce their expenditures, according to a new study by the Brussels-based Center for European Policy Studies. In light of these examples, the task that now lies ahead for Greece is absolutely achievable, the authors conclude. Their only qualification is that "adjustments of this magnitude take time, typically at least five years." For politicians, an austerity program is undoubtedly the most uncomfortable approach. "It's possible that we won't survive this," Irish Finance Minister Brian Lenihan concedes. Voters rarely reward efforts to save money, usually voting the politicians deemed responsible out of office instead. This is why the second, supposedly pain-free strategy is so attractive to politicians: Confronting the mountain of debt with the help of inflation. In other words, governments simply print money. Firing Up the Printing Presses US President Barack Obama, in particular, is likely to be very tempted to fire up the money printing presses and, by devaluing the currency, to reduce the real burden of liabilities the United States has accumulated. Because foreign investors in China and Japan hold a large share of America's debts, they would be more adversely affected by depreciation than the Americans themselves. Inflation has other advantages from the government's perspective. When prices rise, the government collects more revenue. This improves its ability to repay its debt, because the value of the debt also declines daily. For this reason, Paul Krugman, winner of the Nobel Prize in Economics, advised the president to try using the tool of inflation before raising taxes or cutting spending. His recipe for the crisis consists of "vigorous growth and moderate inflation." In recent months, the American central bank, the Federal Reserve, has already availed itself of a modern version of printing money: It simply spent hundreds of billions of dollars to buy up government debt in the form of treasury bonds. The approach, known as quantitative easing, keeps returns and interest rates low. The only question is when the Fed will flick the switch -- in other words, when and to what extent it will start re-collecting the money with which it has flooded the markets. If it doesn't do so, or does so only with hesitation, all the capital in the markets could stimulate demand to such a degree during the next recovery that prices would rise dramatically. If that happens, the debt would quietly be reduced through inflation. Savers and foreign investors, who would be partly expropriated, would be at the losing end of such an approach. Spinning Out of Control Besides, there are many hidden risks to this approach. Inflation is hard to manage and can easily spin out of control. Germany has had bitter experiences with out-of-control inflation in its history. In 1922 and 1923, an explosion in consumer prices ended in hyperinflation. At the time, investors sought refuge in tangible assets: real estate, farmland and, most of all, precious metals. A similar trend is already taking shape today, as prices for gold and silver reach record highs. The third strategy countries can employ to reduce their national debt also has unpleasant consequences: They stop making payments, either in full or in part. Such cases have happened hundreds of times throughout history, and yet no guidelines exist on how debtors and creditors are to proceed. "There is no legal framework for national bankruptcies," says Klaus Abberger, an economics with the Munich-based Ifo Institute for Economic Research. As far back as 1776, Adam Smith, the father of modern economists, pointed out the need for a legal system to deal with national bankruptcies. "A fair, open and avowed bankruptcy," the moral philosopher wrote, "is always the measure which is both least dishonourable to the debtor, and least hurtful to the creditor." Restructuring Debts More than two centuries later, Greece would undoubtedly be a candidate for such a bankruptcy proceeding -- that is, if the politicians in the euro zone weren't so terrified of the consequences. If that were to happen, the government in Athens would have to sit down with its creditors and negotiate how much of its debt it could repay. It is high time to think about how this would work, says Clemens Fuest, an economist at the University of Oxford. "We have to prepare a debt restructuring, so that the creditors are at least involved in the costs," Fuest insists. On the other hand, he says, if the Greek bonds were serviced in full, "taxpayers would be short-changed once again, just as they were in the banking crisis." In the end, some governments will probably put all three strategic levers into motion to overcome the debt crisis. Even if they don't actively fuel inflation, at least they won't be fighting it rigorously. They will restructure the debts of hardship cases like Greece. Most of all, however, they will seek to balance their budgets by raising revenues and reducing expenditures. When that happens, at least everyone will suffer: not just taxpayers, but also savers and lenders. Only then could states be able to get their affairs back in order. However, one key element is still missing: The economy has to grow, so that the government can collect enough tax revenue and thus reduce its debt. The trick, in other words, will be to save money while at the same time expanding aggregate output. This is the dilemma that governments face: debt and cutbacks curb growth, but debt reduction cannot succeed without growth. Whether there is in fact a way out of this quandary will soon become apparent - in the case of Greece. http://www.spiegel.de/international/europe/0,1518,692666,00.html

|

Од истог аутора

Остали чланци у рубрици

- Playing With Fire in Ukraine

- Kosovo as a res extra commercium and the alchemy of colonization

- The Balkans XX years after NATO aggression: the case of the Republic of Srpska – past, present and future

- Из архиве - Remarks Before the Foreign Affairs Committee of the European Parliament

- Dysfunction in the Balkans - Can the Post-Yugoslav Settlement Survive?

- Serbia’s latest would-be savior is a modernizer, a strongman - or both

- Why the Ukraine Crisis Is the West’s Fault

- The Ghosts of World War I Circle over Ukraine

- Nato's action plan in Ukraine is right out of Dr Strangelove

- Why Yanukovych Said No to Europe

.jpg)

Der Spiegel staff

Der Spiegel staff